WTA Chairman’s Update #11: October – December 2018

Dear WTA Members, observers and friends:

First, on a personal note, I want to let everyone know that I will not be seeking re-election as chair of World Taxpayers Associations next May at our General Meeting in Sydney. I have very much enjoyed almost 10 years of involvement on the WTA board with three as your chairman. However, I’ve recently made a decision to step down as president of the Canadian Taxpayers Federation and look for new opportunities and challenges in life. I believe strongly that renewed leadership is critical for organizations to thrive – and have no doubt WTA will remain on an upward trajectory under new leadership going forward.

Upcoming WTA Events:

The first WTA-sponsored Regional Taxpayers Forum of 2019 will take place in Chisinau, Moldavia, March 28-29th 2019. The World Taxpayers Associations along with Americans for Tax Reform and the European Resource Bank Meeting are pleased to invite delegates to join us in an exchange of ideas and best practices to advance taxpayer advocacy in Europe.

Registration and fees:

Conference fees include conference materials, coffee breaks and lunches.

If you have paid your 2019 Membership Fee to the WTA, you are entitled to free access to this event. Please e-mail Melanie Harvie at melanie.harvie@worldtaxpayers.org for your discount code. The code is valid for two registrants within your organization until February 15th, 2019. After that, a fee of $50 USD per person will be charged.

More information will soon be available on WTA’s website and partnering organizations.

Location:

Academy of Economic Studies of Moldova

Banulescu-Bodoni 61,

MD-2005, Chisinau, Republic of Moldova

Agenda:

Thursday, March 28th

8:00 AM – 2:00 PM Coalition Leaders Forum

2:00 PM – 5:30 PM Taxpayers Regional Forum

Friday, March 29th

8:30 AM – 12:00 PM Taxpayers Regional Forum

12:00 PM – 7:00 PM European Resource Bank Meeting

Saturday, March 30

9:00 AM – 10:00 PM European Resource Bank Meeting

Sunday, March 31st

9:00 AM – 12:00 PM European Resource Bank Meeting

We look forward to welcoming you in Moldavia in March.

17th World Taxpayers Conference in Sydney, Australia May 23-26, 2019

In May 2019 World Taxpayers Associations along with the Australian Taxpayers’ Alliance and Tax and Super Australia is pleased to invite delegates from across the world to join us in Sydney for four days exchanging ideas and best practices to advance the cause of limited and accountable government. This gathering will also hold the General Meeting and board elections for WTA.

Join over 500 taxpayer activists and freedom fighters in Sydney for what will be the biggest and best pro-liberty event of 2019 – the 17th World Taxpayers’ Conference combined with the 7th Annual Friedman Conference!

More information about the conference can be found here.

Past Events:

Regional Taxpayers Forum in Lima, Peru, October 12-14th 2018

Twenty-three delegates from 12 countries joined in Lima, Peru for the second Regional Taxpayers Forum of 2018, and the first ever WTA event in Latin America. The event sponsored by World Taxpayers Associations, Americans for Tax Reform and Peruvian Taxpayers Association (Asociación de Contribuyentes del Perú) focused on advancing the taxpayer movement in Latin America. Attendees shared ideas on fundraising, social media, coalition meetings, tax reform, and on how to implement free-market public policies in Latin America. Previous to the event, the Peruvian Taxpayers Association held their first Taxpayers Forum in Peru, where more than 50 attendees gathered to learn from local and international speakers on the importance of property rights and tax reform for economic growth. Thank-you, to ATR and ACP for their collaboration and to everyone who participated.

Member News:

CANADA AND SWEDEN: Go to War Over Olympics …

What is usually fought out in the hockey rink between Sweden and Canada is now a public relations battle with maple syrup and Swedish meatballs being tossed across the North Atlantic.

The Canadians fired the first shot. You see, the Canadian Taxpayers Federation (CTF) has long been a critic of hosting costly Olympic Games. At issue is the City of Calgary seeking to land the 2026 Winter Olympics. The CTF has brought enough opposition to the bid that the city is holding a plebiscite on the matter November 13th. The CTF is leading the NO vote campaign!

But all is not lost. The CTF’s solution is simple: get behind the competing bid which is currently being put forward by Stockholm Sweden. At a press conference, the CTF officially announced its support for the 2026 Stockholm Winter Olympic bid arguing it will save Canadian taxpayers billions and no doubt be better run. You can see a video here and news coverage here.

Not so fast say the Swedes. The Swedish Taxpayers Association (Skattebetalarna) issued a statement arguing Calgary would be a much better host with colder temperatures than Stockholm and since Canada has lower taxes than Sweden, Canada can better afford it. Referring to the 1998 and 2010 Winter Olympic Games, Skattebetalarna president Christian Ekstrom launched a counter campaign called “Make Canada Pay Again.” You can read more news coverage here. And a recent Guardian analysis on growing Olympic largesse here.

We’ll have an update for you in the next newsletter!

UNITED STATES: Tax Foundation Launches 2018 International Tax Competitiveness Index

The International Tax Competitiveness Index is a powerful tool that can help you identify strengths and weaknesses with your country’s tax code, and develop a road map towards positive reforms.

For the fifth year in a row, Tax Foundation found that out of all OECD countries, Estonia’s tax code is the most competitive and neutral, followed closely by Latvia (#2), New Zealand (#3), Luxembourg (#4), and the Netherlands (#5).

On the other side of the spectrum, France has the least competitive and least neutral tax system in the OECD, followed by Italy (#34), Poland (#33), Portugal (#32), and Chile (#31).

To help better understand these results, and to jumpstart the tax reform debate in your country, the Tax Foundation has put together a “Tax Reform Toolkit”

In addition to the full report, the Tax Foundation has made available short summaries of the strengths and weaknesses of each country’s tax code, and a short guide on how to navigate and use the Index.

CROATIA: Lipa a 2018 Templeton Freedom Award Finalist

Lipa, Croatian Taxpayers Association has been nominated as the 2018 Templeton Freedom Award Finalist for its campaign to protect Croatia’s homeowners.

Nearly 90 percent of Croatians own their own homes, so when the Croatian government passed a property tax for the first time in 2017, Lipa refused to stand by and allow this property tax to hit an already troubled economy. Its efforts led to the tax’s full repeal.

CANADA: Film Award Finalist

The Canadian Taxpayers Federation is also shortlisted for an Atlas Network Award: The Lights Camera Liberty Film Festival Award for its video drawing attention to the growing tax differential between beer in Canada and the United States.

UKRAINE: Taxpayers Association of Ukraine Holding Third “Level Up Ukraine” Business Forum

Taxpayers Association of Ukraine (TAU) in partnership with Deloitte is organizing an outstanding business forum “LЕVEL UP UKRAINE 2018.” The main goal of the forum is to create a platform for an open discussion on tax and investment decisions between the state, businesses and potential international investors.

The forum will bring together key players of Ukrainian and international entrepreneurs, including investors, regulators and experts.

TAU is pleased to invite members of WTA to this event. The forum will take place on November 28, 2018 at the Fairmont Grand Hotel Kyiv (1 Naberezhno-Khreshchatytska Street, Kyiv). In addition, TAU’s 20th anniversary will be celebrated on November 30, 2018.

Contact Polina Kolodyazhna, email: polinakolodyazhna@ukr.net, mobile phone: (viber, whatsApp): +38 (063) 416 55 91.

UNITED STATES: Trump’s Tariffs Now Cost Americans More Than Obamacare Taxes says National Taxpayers Union

Bryan Riley and Andrew Wilford from NTU explain that the latest round of tariffs now means that the total tax increase on Americans from enacted tariffs exceeds the tax increases from the Affordable Care Act, (un)popularly known as “Obamacare.” On Sept. 19, President Trump imposed a 10 percent tax on $200 billion of Chinese imports. On Jan. 1, 2019, this tax will rise to 25 percent. But even without that January tariff rate increase, trade taxes on American businesses and consumers will exceed those of the ACA. Read full story here.

UNITED KINGDOM: Taxpayers Alliance’s Small Victory

Following TaxPayers’ Alliance recent research on mayoral car spending, Scarborough council are set to review their use of hire cars for ceremonial duties, potentially saving thousands of pounds per year! To read more on this story click here.

Also, the TaxPayers’ Alliance has formally submitted a representation for Budget 2018, calling for a cut to Air Passenger Duty. The UK has the highest short and long-haul aviation tax anywhere in Europe. Countries nearby, like Ireland, have abolished their air taxes. Northern Ireland gets hit particularly bad, as holidaymakers head to Dublin to dodge the unnecessary costs. Flying does have consequences, like emissions and noise for people who live right near airports, but the £3.5 billion it raises pays for those many times over.

Read the submission here.

Reports:

WORLD: Property Rights Alliance Releases its 2018 International Property Rights Index

Property Rights Alliance, in partnership with the Free Market Foundation in South Africa and in cooperation with 113 think tanks across the world released the 2018 International Property Rights Index. The Index measures the strength of physical property rights, intellectual property rights, and the legal and political environments that contain them.

For the first time the United States fell from being 1st in the world for intellectual property protections to 2nd, yielding to Finland, which also passed New Zealand to become 1st in the Index overall (8.69). The Index is also the first publication to utilize the recently updated Patent Rights Index developed by Professor Walter Park at American University.

Property rights are a key indicator of economic success and political stability. Renowned economist Hernando De Soto said, “weak property rights systems not only blind economies from realizing the immense hidden capital of their entrepreneurs, but they withhold them from other benefits as evidenced through the powerful correlations in this year’s Index: human freedom, economic liberty, perception of corruption, civic activism, and even the ability to be connected to the internet, to name a few.” For more information, click here.

CHILE: Tax Freedom Day

A recently released study of Ciudadano Austral inspired by the latest Taxpayers Regional Forum in Peru, just released a new study on Tax Freedom Day in Chile that concludes that the whole income of Chileans from October 23 to December 31 2018 is going directly to the tax collecting agency. Chileans are working 70 days for the government, one more than in 2016 and 17 more than in 1990.

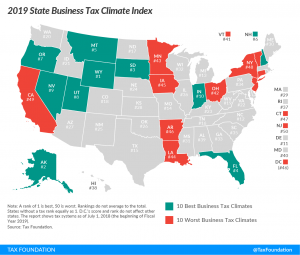

UNITED STATES: Tax Foundation Releases 16th State Business Tax Climate Index

The Tax Foundation released the 16th edition of its State Business Tax Climate Index. The State Business Tax Climate Index is a measure of how well states structure their tax systems. It enables policymakers, business leaders and taxpayers to gauge how their states’ tax systems compare, and provides a roadmap for improvement.

To read the full report click here.

FRANCE: The Social and Fiscal Contribution of France’s Top 40 Companies

The social and fiscal contribution from large companies in France and worldwide remains largely unrecognized. Traditional financial accounting devised to present corporate earnings, focuses on financial data and understates the benefits for the French and global community while overstating shareholders’ income by presenting dividends before taxes. A study by Institut Économique Molinari aims to remedy this.

It presents a new way of quantifying the social and fiscal contribution from the top 40 companies and how it is shared between employees, governments and shareholders. It shows that the 40 companies created €338 billion in wealth for the French and global community in 2016. This €338 billion generated €240 billion in wealth for employees, €66 billion for French and foreign governments and a net €32 billion for shareholders.

Read the full report here.

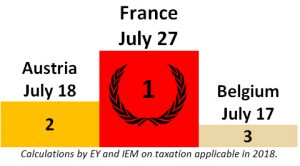

EUROPE: The Tax Burden of Workers in the EU — 2018

Institut Économique Molinari published for the ninth year in a row, its study on the actual tax and social burden faced by the average employee in the European Union (EU). This ranking has the distinct feature of showing the pressure endured by average employees for the current year, using a solid methodology applied uniformly throughout the EU and providing a good grasp of the true impact of taxes and charges and of the shifts that are occurring.

TAX AND SOCIAL FREEDOM DAYS IN 2018 FOR THE AVERAGE EMPLOYEE

Read the full report here.

SLOVAKIA: Bureaucracy Index

The Institute of Economic and Social Studies (INESS) first introduced its Bureaucracy Index in Slovakia in 2016 to draw the attention to the amount of red tape a small entrepreneur has to overcome on a daily basis just to do business.

The index is based on a straightforward methodology, using an analysis of a model company (micro-company with 4 employees producing blacksmith products) and all its bureaucratic duties (ranging from taxes, worktime planning through health, safety, and waste management) are assigned a specific time cost. This year, Slovakia was joined by think tanks from Lithuania (Lithuanian Free Market Institute), Czech Republic (Liberální Institut) and Ukraine (EasyBusiness) who announced their 2018 national results in the first half of October 2018.

If you are interested to learn more about the Bureaucracy Index or even join and prepare your own country calculations for 2019, visit bureaucracyindex.org/.

Save the Date!

Upcoming Atlas Network Events:

Liberty Forum and Freedom Dinner 2018

November 7-8

New York City, United States

February 28 – March 1, 2019

Colombo, Sri Lanka

Europe Liberty Forum 2019

May 8-9

Athens, Greece

In closing, I’d like to encourage everyone to please visit our website and our Facebook group. Our community is only as strong and as beneficial as we choose to make it. Please work with our Secretary General Cristina Berechet to feed good content into this newsletter and our network at large.

Keep up the fight!

Troy Lanigan

Chair, World Taxpayers Associations

President, Canadian Taxpayers Federation

E-mail | troy.lanigan@worldtaxpayers.org

Skype | troy_lanigan